Manage fuel surcharges

Accurately manage Fuel Levy Rates and surcharges

Trusted choice by nearly 100,000 businesses

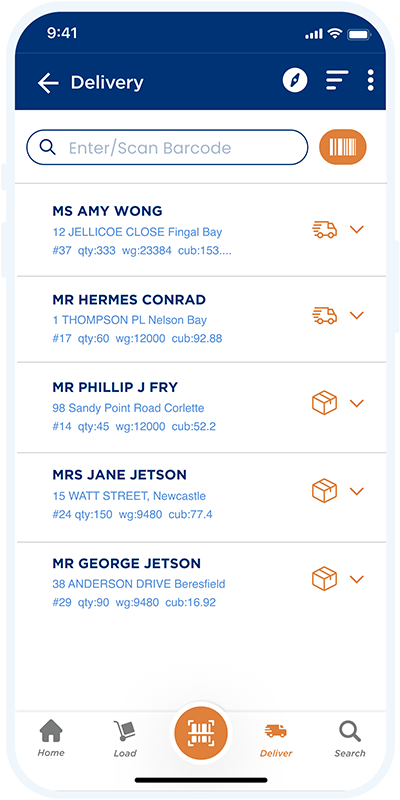

Update fuel levy rates on the go.

Set one levy for everyone, apply the same levy to multiple customers, or customise individual levies. This feature also helps you keep up with fuel price changes to protect your revenue.

Before

Transvirtual

vs.

- Miscalculations and inconsistencies

- Revenue loss, surcharges are often overlooked and unaccounted for

-

Manual surcharges were time-consuming and resource-exhaustive

- Limited flexibility in levy application across customers

- Risk of underquoting

After

Transvirtual

- Precise surcharge calculations

- Capture every charge, precisely track costs on a per-job basis

- Streamline surcharge application with automated, real-time calculations.

- Tailor levy rates for different customers, zones, and freight types

- Clear, consistent pricing models

Calculate fuel levy surcharges easily

Calculate fuel levy surcharges

Keep up with price fluctuations

Stop underquoting your transport and logistics services. Set base rates and fuel percentages to quote jobs quickly and accurately.

With Transvirtual, you can easily set up and customise levies and surcharges as either percentages or flat rates, and even tie them to specific dates or ranges.

Customise levies

Set variables

Set distinct levies for customers, agents, and on-forwarders while customising them to your needs. Organise by zones (metro vs. regional) or freight types (carton vs. pallet).

We’ll adapt the system to suit you, allowing levies per consignment or invoice using percentages or flat rates.

Understanding Fuel Surcharge Calculation

Calculating Fuel Surcharges Accurately

To set fair fuel surcharges, transport companies need to watch fuel prices closely. These charges are typically shown in cents per liter and reflect real fuel costs. This method helps keep freight rates in line with the always-changing fuel market, protecting both companies and clients from unexpected expenses.

Being Open About

Fuel Surcharge

Clear communication about fuel surcharges is crucial for building trust with clients. Transport companies should explain plainly how changes in fuel prices lead to adjustments in surcharges. This openness helps customers understand why their freight rates might change and makes extra costs more predictable and reasonable.

Join over 10,000+ ecstatic transport and logistics companies

Our transport solutions have over 500 configurable features designed to solve your most complex challenges

Our entire business has been positively impacted by the TransVirtual technology solution, it has allowed the business to scale without creating or increasing inefficient manual

processes.

Built for scale

Anthony Tanner

CEO, VT Freight Express

TransVirtual has reduced customer enquiries by 50% and given our customers full visibility throughout the delivery process. We have also been able to review set routes and find major

cost savings.

50% reduction in customer queries

Luke O’Shannassy

General Manager, Caledonian Transport

Automation prevented revenue leakage within the business, so a massive benefit for us from a profit perspective, that automation also allowed us to significantly reduce our staff headcount.

40% increase in revenue

Richard Tesoriero

CEO, Hunter Express

Our entire business has been positively impacted by the TransVirtual technology solution, it has allowed the business to scale without creating or increasing inefficient manual

processes.

Built for scale

Anthony Tanner

CEO, VT Freight Express

Automation prevented revenue leakage within the business, so a massive benefit for us from a profit perspective, that automation also allowed us to significantly reduce our staff headcount.

40% increase in revenue

Richard Tesoriero

CEO, Hunter Express

TransVirtual has reduced customer enquiries by 50% and given our customers full visibility throughout the delivery process. We have also been able to review set routes and find major

cost savings.

50% decrease in customer queries

Luke O’Shannassy

General Manager, Caledonian Transport

Frequently asked questions

A fuel levy rate is an additional surcharge applied on top of your standard transport fee. Keeping on top of fuel-price variances is important to prevent lost revenue. Easily customise and update fuel levy surcharges on the go, instead of having a fixed rate. This helps companies stay competitive and profitable.

A fuel surcharge helps transport companies manage the impact of fluctuating fuel prices. It allows them to adjust freight rates in response to changes in fuel costs, ensuring fair pricing for both the company and its customers. This approach helps maintain service quality without compromising profitability as fuel prices shift.

Calculating a fuel surcharge involves monitoring current fuel prices and determining the additional cost per liter of fuel used. Transport companies typically express this as a percentage of the base freight rate or as a fixed amount per mile/kilometer. The specific formula may vary, but it generally considers factors such as average fuel consumption, distance traveled, and the difference between current and baseline fuel prices.

Fuel prices significantly affect transport services, particularly for companies operating heavy vehicles. Rising fuel costs can increase operational expenses, potentially leading to higher freight rates. Conversely, falling prices may allow for more competitive pricing. Transport companies must balance these fluctuations to maintain service quality while meeting customer expectations for fair pricing.

Effective fuel levy calculation involves carefully considering current fuel costs when determining freight rates. Transport companies can offset fuel expenses by integrating this data into their pricing models.

Additionally, leveraging fuel tax credits, especially for heavy vehicles, can help reduce net fuel costs. By accounting for these factors, companies can create more accurate and fair fuel levies that benefit both the business and its clients.

Fuel tax credits are government incentives that allow eligible businesses to claim back some or all of the fuel tax (excise or customs duty) included in the price of fuel used in their business activities, particularly for off-road use or heavy vehicles used on public roads.

Still have questions?

Speak to an expert

Let's solve your key challenges

Talk to one of our Transport Management System strategists to save you time and money. Your customers will thank you!

Book your strategy session now to:

1

Share your key problems

2

Receive high level solutions

3

As a good fit you’ll

book in a tailored demo