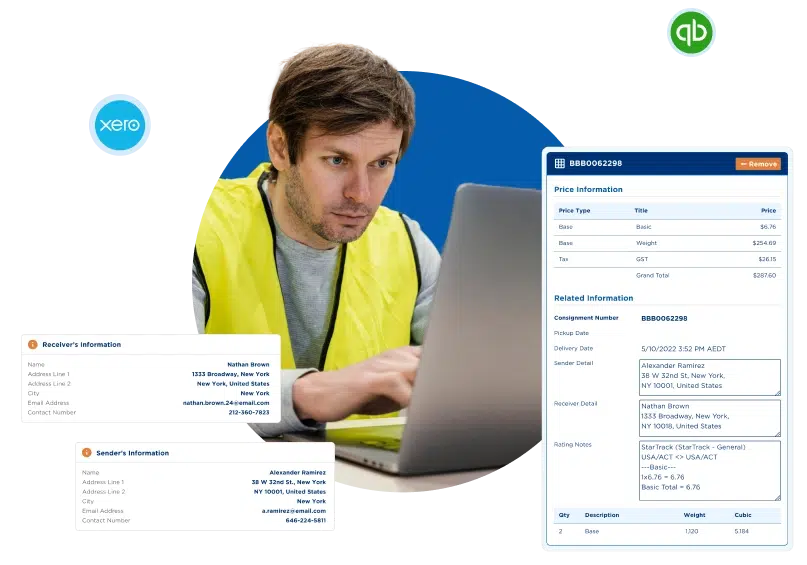

Reverse invoicing made simple

Accurately issue reverse invoices

Trusted choice by nearly 100,000 businesses

Automated reverse invoicing

Before

Transvirtual

vs.

- Buyers manually generate invoices, leading to errors and delays

- Inconsistent processes across different business partners

- Time-consuming back-and-forth for invoice management

- Difficulty managing multiple reverse invoicing accounts

- Lack of integration with existing systems

- Limited control over invoicing workflows

After

Transvirtual

- Automated reverse invoicing eliminates manual input and errors

- Standardized invoicing for partners or contract accounts

- Seamlessly validate and generate invoices

- Effortlessly manage of numerous accounts in one system

- Fully integrated with Transvirtual for seamless data exchange

- Complete control and transparency in your invoicing process

Reduce the time spent managing supplier invoices.

Reverse Invoicing Simplified

Generate Invoices for Your Network

Build Trust and Avoid Costly Errors

Join over 10,000+ ecstatic transport and logistics companies

Our transport solutions have over 500 configurable features designed to solve your most complex challenges

Our entire business has been positively impacted by the TransVirtual technology solution, it has allowed the business to scale without creating or increasing inefficient manual

processes.

Built for scale

Anthony Tanner

CEO, VT Freight Express

TransVirtual has reduced customer enquiries by 50% and given our customers full visibility throughout the delivery process. We have also been able to review set routes and find major

cost savings.

50% reduction in customer queries

Luke O’Shannassy

General Manager, Caledonian Transport

Automation prevented revenue leakage within the business, so a massive benefit for us from a profit perspective, that automation also allowed us to significantly reduce our staff headcount.

40% increase in revenue

Richard Tesoriero

CEO, Hunter Express

Our entire business has been positively impacted by the TransVirtual technology solution, it has allowed the business to scale without creating or increasing inefficient manual

processes.

Built for scale

Anthony Tanner

CEO, VT Freight Express

Automation prevented revenue leakage within the business, so a massive benefit for us from a profit perspective, that automation also allowed us to significantly reduce our staff headcount.

40% increase in revenue

Richard Tesoriero

CEO, Hunter Express

TransVirtual has reduced customer enquiries by 50% and given our customers full visibility throughout the delivery process. We have also been able to review set routes and find major

cost savings.

50% decrease in customer queries

Luke O’Shannassy

General Manager, Caledonian Transport

Frequently asked questions

Reverse billing works as follows:

- Agreement: Both customers and suppliers agree on contract terms.

- Instead of the supplier issuing the invoice, the customer calculates the payables and generates the invoice

- Supplier reviews and approves invoice

- Customer processes the payment

Reverse billing is especially useful in industries with complex supplier networks or frequent transactions.

To implement Recipient Created Tax Invoices (RCTIs), the following documentation is required:

Written Agreement:

- Both parties (customer and supplier) must sign a valid written agreement.

- The agreement should outline the terms, including agreed rates, payment terms, and GST requirements.

Compliance with Tax Regulations: The agreement must comply with the Australian Taxation Office (ATO) requirements for RCTIs.

Industry Standards: Documentation should align with industry-specific invoicing and compliance standards.

Still have questions?

Speak to an expert